This is the Recycling, Scrap Metal, Commodities and Economic Report, April 7th, 2025.

U.S. weekly raw steel production rose slightly to 1.697MT up .1% from last year, but down 1.3% YTD. Steel mills’ earnings are falling as auto manufacturers canceled orders. Auto tariffs will raise prices which will hurt auto and steel demand.

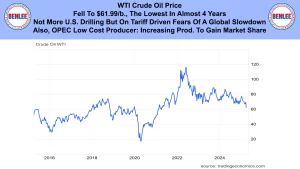

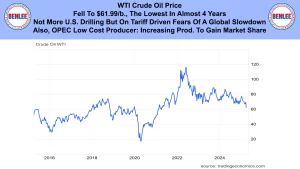

WTI crude oil price fell to $61.99/b., the lowest in almost 4 years. This was not on more U.S. drilling but on tariff driven fears of a global slowdown. Also, OPEC, who is the low cost producer is increasing production to gain market share.

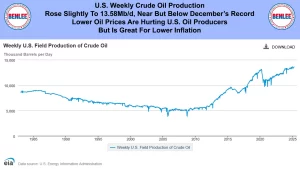

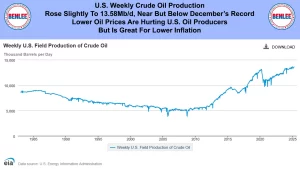

U.S. weekly crude oil production rose slightly to 13.58Mb/d, near, but below December’s record high. Lower prices are hurting U.S. oil producers, but is great for lower inflation.

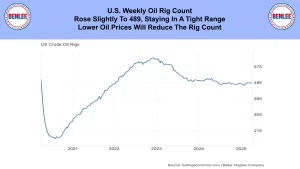

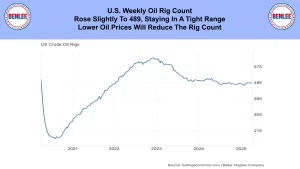

The U.S. weekly oil rig count rose slightly to 489, staying in a tight range. Lower oil prices will reduce the rig count.

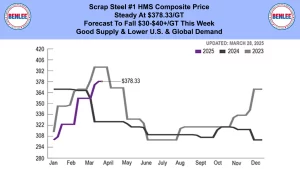

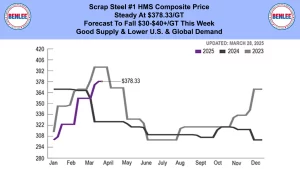

Scrap steel #1 HMS composite price was steady at $378.33/GT. It is forecast to fall $30-$40/GT or more this week. This is on a good supply and lower U.S. and global demand.

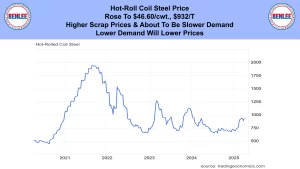

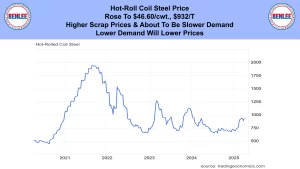

Hot-rolled coil steel price rose to $46.60/cwt., which is $932/T. This was on higher scrap prices and about to be slower demand. Lower demand will lower prices

Copper price fell hard to $4.39/lb., one of the largest weekly drops in history. It was on concerns over a trade war which will slow global demand.

Aluminum price fell to $1.08/lb., $2,378/MT on the same trade war concerns.

Atlanta Federal Reserve GDP Now Forecast for Q1 2025 shows a negative 2.8%, but after adjustment for gold imports and exports, it is negative by just .8%. Both are a sharp slowdown in the economy vs about 3% on 2023 and 2024.

U.S. February trade deficit improved slightly to $122.7B. Exports rose to a record. Note that BMW and Mercedes are major U.S. exporters, yes exporters. Imports fell slightly from January’s record but were still high to beat tariffs.

U.S. March ISM Manufacturing Purchasing Managers’ index fell to 49, with the first contraction in factory activity in 3 months. New orders, backlogs, and employment all fell faster. Also, price pressure soared to the highest since June 2022 as new tariffs hit U.S. companies.

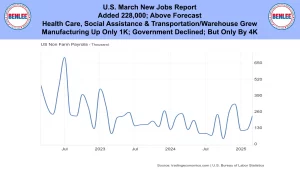

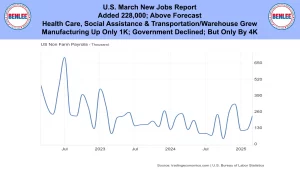

U.S March jobs report had companies add 228,00 jobs, which was above forecast. Health care, social assistance and transportation and warehousing grew. Manufacturing was up only 1,000 and government declined but by only 4,000.

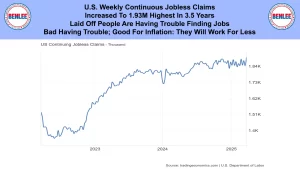

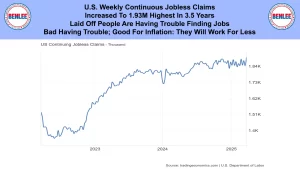

U.S. weekly continuous jobless claims increased to 1.93M the highest in 3.5 years. Laid off people are having trouble finding jobs. It is bad that they are having trouble, but it is good for inflation. They will work for less.

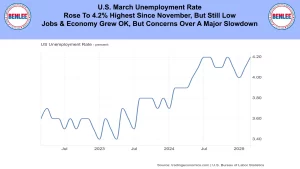

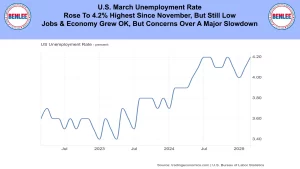

U.S. March unemployment rate rose to 4.2% the highest since November, but still low. Jobs and the economy grew ok but there are concerns over a major slowdown.

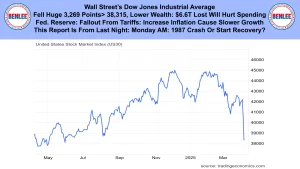

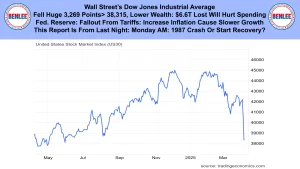

Wall Street’s Dow Jones Industrial average fell 3,269 points to 38,315. The lower wealth effect, with $6.6T lost on just Thursday and Friday will hurt spending and the economy. The Federal Reserve said the fallout from tariffs will increase inflation and cause slower growth. This report is from last night. Will Monday morning bring a 1987 type crash which was 22.6% or be the start of a recovery?

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.

Member

Member