This is the Recycling, Scrap Metal, Commodities and Economic Report, January 6th, 2025.

U.S. weekly raw steel production was up slightly to 1.66MT, down 2.8% from last year and down 2.5% YTD. This was on continued slow U.S. manufacturing.

U.S. dollar index, which is the U.S. dollar vs other global currencies rose to 108.9. Leaving out the COVD peak, it was the highest since 2012. The cause is, the strong U.S. economy which is keeping interest rates higher for longer. Note that the high dollar puts downward pressure on commodity prices that are priced in U.S. dollars.

WTI crude oil price rose to $73.96/b, despite the strong U.S. Dollar. Cold weather in the U.S. and Europe drove demand, but Chinese bearish demand forecasts remain, due to strong EV sales.

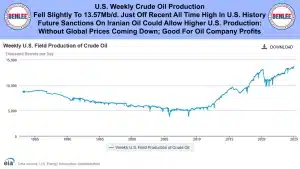

U.S. weekly crude oil production fell slightly to 13.57Mb/d just off the recent all-time high in U.S. history. Future sanctions on Iranian oil could allow higher U.S. production without global oil prices coming down, which is good for oil company profits.

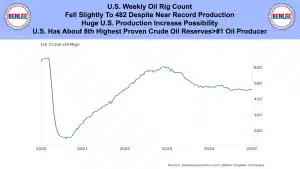

The U.S. weekly oil rig fell slightly to 482 despite near record production. There is a huge U.S. production increase possibility. The U.S. has about the 8th highest proven crude oil reserves, but is the #1 crude oil producer.

Scrap steel #1 HMS composite price was steady at $303.33/GT. There is no clear direction for January, despite slow demand. The strong U.S. dollar raises the net cost to others to buy U.S. exports.

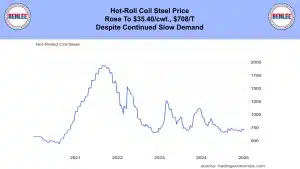

Hot-rolled coil steel price rose to $35.40/cwt., $708/T despite continued slow demand.

Copper price fell to $4.08/lb., on the strong U.S. dollar and weaker than expected Chinese economic data.

Aluminum price fell to $1.13/lb., $2,496/MT on the same strong U.S. dollar and weak global manufacturing and construction.

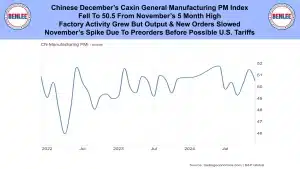

Chinese December’s Caxin general manufacturing purchasing managers’ index fell to 50.5, from November’s 5 month high. Factory activity grew, but output and new orders slowed. November’s spike was due to preorders before possible U.S. tariffs.

U.S. weekly home 30-year fixed mortgage rate rose to 6.97% the highest since July. The above average trend growth economy and 8 years of high government deficits together are causing higher interest rates.

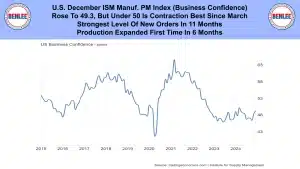

U.S. December ISM Manufacturing purchasing managers’ index which is business confidence. It rose to 49.3, but under 50 is contraction. It was the strongest level of new orders in 11 months and production expanded for the first time in 6 months.

U.S. weekly initial jobless claims fell to 211,000 the lowest in 8 months. The huge slowdown in immigration is causing a tighter labor force. Tighter labor force brings higher wages and inflation, which causes higher interest rates.

Wall Street’s Dow Jones Industrial Average fell 108 points to 42,732. Good economic growth is slowing interest rate cuts. Also, the high as in strong U.S. dollar hurts U.S. company profits that sell overseas.