This is the Recycling, Scrap Metal, Commodities and Economic Report, January 13th, 2025.

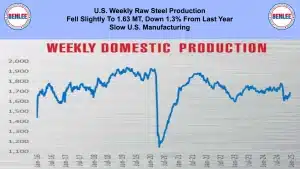

U.S. weekly raw steel production fell slightly to 1.63MT down 1.3% from last year on slow U.S. manufacturing.

WTI crude oil price rose to $76.57/b., on fresh sanctions on Russian oil that is now hurting global supply. This is a major opportunity for U.S. oil company exports.

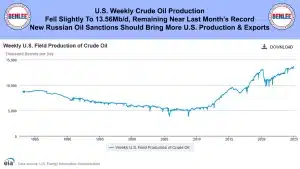

U.S. weekly crude oil production fell slightly to 13.56Mb/d remaining near last month’s record. New Russian oil sanctions should bring more U.S. production and oil exports.

The U.S. weekly oil rig fell slightly to 480 despite near record U.S. production. Tighter supply brings higher prices which brings increased production.

Scrap steel #1 HMS composite price rose $20/GT to about $323/GT. Bad weather is hurting supply so bringing higher prices. The high U.S. Dollar is hurting U.S. scrap exports as they increase the price in local currencies.

Hot-rolled coil steel price fell slightly to $35.20/CWT, $704/T on continued slow U.S. demand.

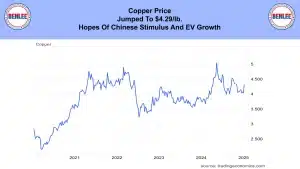

Copper price jumped to $4.29/lb., on hopes of Chinese stimulus and EV growth.

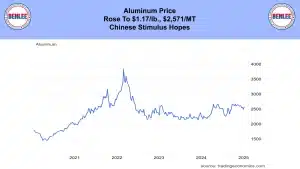

Aluminum price rose to $1.17/lb., $2,571/MT on the same Chinese stimulus hopes.

The U.S. November trade balance widened as in became worse to $78.2B, despite record U.S. exports. Food, semiconductors, cars, and aircraft led imports. As an example, Nvidia chips are designed mostly in the U.S. but imported into the U.S. from Tawain. U.S. Exports were led by crude oil, yes crude oil exports, cars, trucks, buses, and aircraft engines.

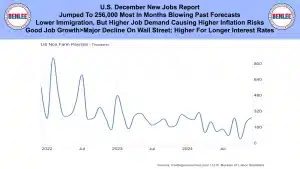

U.S. December new jobs report jumped to 256,000 the most in months and blew past forecasts. Lower immigration, but higher job demand is causing higher inflation risks. The good job growth caused a major decline on Wall Street, due to it could mean higher for longer interest rates.

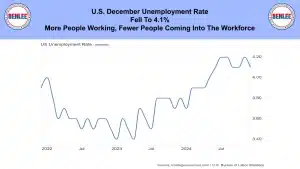

U.S. December unemployment rate fell to 4.1%. More people are working and fewer are coming into the workforce.

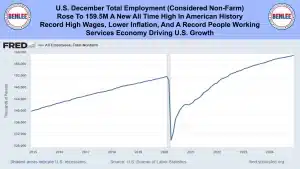

U.S. December total employment which is considered non-farm. It rose to 159.5 million a new all-time high in American history. There are record high wages, lower inflation and a record number of people working, as the services economy is driving U.S. growth.

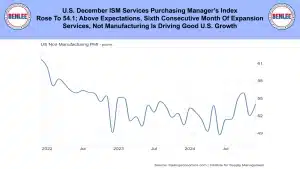

U.S. December ISM Services purchasing managers index rose to 54.1 which was above expectations and the sixth month of expansion. Services, not manufacturing is driving good U.S. growth.

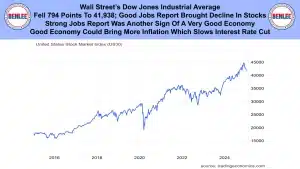

Wall Street’s Dow Jones Industrial Average fell 794 points to 41,938 as the good jobs report brought a decline in stocks. The strong jobs report was another sign of a very good economy. The good economy could bring higher inflation which slows interest rate cuts as said earlier.