This is the Recycling, Scrap Metal, Commodities and Economic Report, October 14th, 2024.

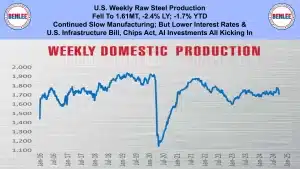

U.S. weekly raw steel production fell to 1.61MT down 2.4% from last year and down 1.7% year to date on continued slow manufacturing. But lower interest rates, the U.S infrastructure bill, the Chips act for massive semiconductor manufacturing and AI data center investments are all kicking in.

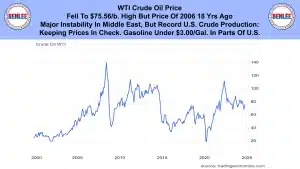

WTI crude oil price fell to $75.56/b., which is high, but the price of 2006, 18 years ago. It’s high because of major instability in the Middle East, but record U.S. crude oil production is keeping prices in check. Gasoline is under $3.00/gallon in parts of U.S.

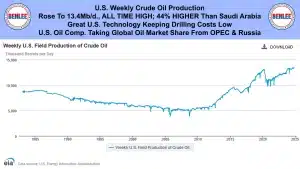

U.S. weekly crude oil production rose to 13.4Mb/d., a new all-time high in American history. That is 44% higher than Saudi Arabia. Great U.S. technology is keeping drilling cost low as U.S. oil companies are taking global oil market share from OPEC and Russia.

The U.S. weekly oil rig count rose to 481, well off 2014’s 1,609 high. But the U.S. is producing a record 60% more oil than 2014 on 30% of the rigs. This hurts drilling and pipeline jobs, but is great for the economy and productivity

Scrap steel #1 HMS price rose to about $325/GT but may have been sideways in the Midwest. This was on slow U.S. manufacturing, but good scrap metal exports.

Hot-roll coil steel price fell to $34.33/cwt., $687/T on continued slow U.S. manufacturing.

Copper price fell to $4.49/lb., but still high based on Chinese government stimulus expectations.

Aluminum price fell to $1.20/lb., $2,638/mt. on the same high Chinese government stimulus expectations.

U.S. September CPI (Consumer Inflation), fell to 2.4%, the lowest in about 3.5 years. People are still mad about higher prices which are real, but many to most are getting record salaries, have record home equity and have record 401Ks.

U.S. September Producer prices, as in wholesale prices, fell to a 1.8% increase vs last year. Prices are high, but inflation is clearly down.

U.S. October U of M consumer sentiment survey fell to 68.9 from September’s 5 month high. Current and future expectations fell, but future business expectations hit a 6-month high. There remains a frustration over high prices despite record salaries and record 401Ks.

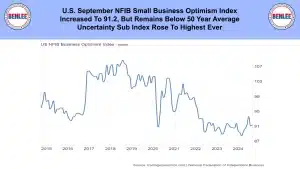

U.S. September NFIB small business optimism index increased to 91.2, but remains below the 50 year average. The uncertainty sub index rose to the highest ever.

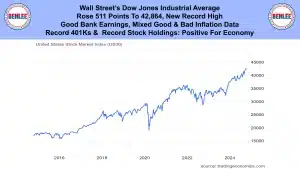

Wall Street’s Dow Jones Industrial Average rose 511 points to 42,864 a new record high. This was on good bank earnings and mixed good and bad inflation data. Record 401Ks and record stock holdings are a positive for the economy.